Money-saving apps help various people save money in a variety of ways. App users can automate savings by rounding up daily purchases, investing small amounts in increments, and receiving discounts on local stores’ items. The following are some of the Best Money Saving Apps:

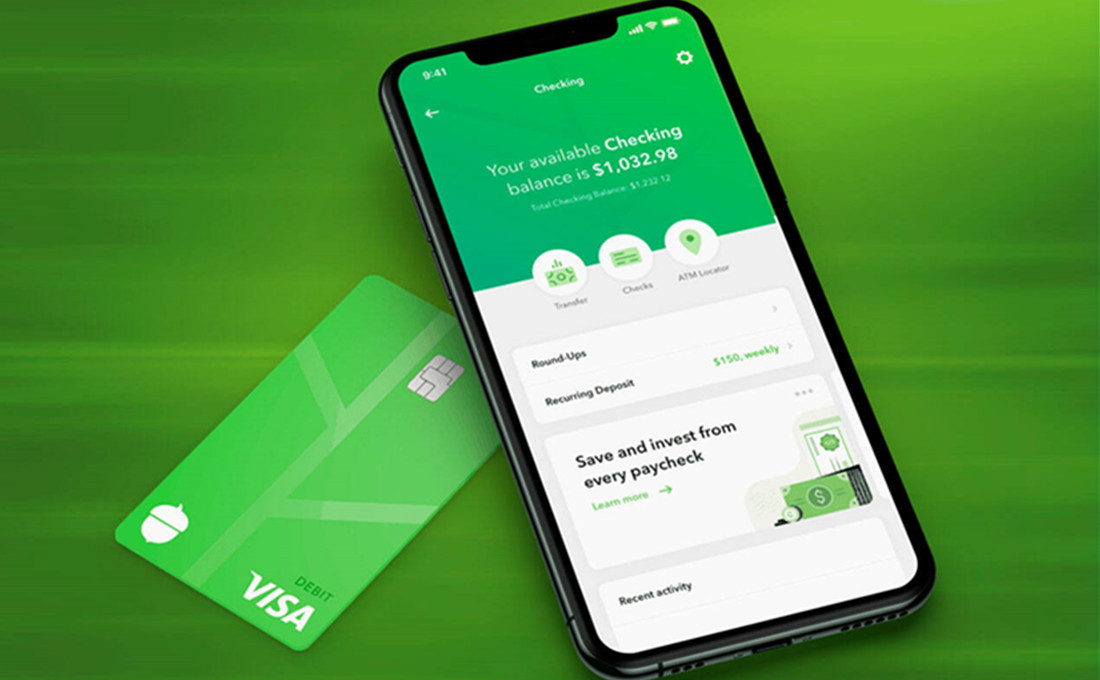

1. Acorns

Touted as the “robot-advisor,” Acorn is an iOS and android money-saving app that rounds up purchases and invests small amounts in a portfolio of ETFs in a fundamental manner. Acorns charge a monthly fee but promise to make more than it costs in fees through investments on the back end. The app’s interface is simple, so someone who has minimal knowledge of investing can quickly get started with Acorns.

2. Level Money

Level Money is a free iOS and android app that rounds up purchases to the nearest dollar and invests small amounts for you in a portfolio of ETFs. The app tracks daily and monthly spending, helps the user set monthly budgets, and creates reports showing how much money is saved by taking public transportation instead of driving.

3. Qapital

Qapital is a free iOS app that sets daily, weekly or monthly rules for savings. The app will then transfer money into separate accounts when the rules are met. Qapital offers bank account, credit card, and debit card funds for saving. It can also notify the user when money is transferred to the account.

4. Ynab (You Need A Budget)

YNAB, also available for Android, allows users to link their checking accounts to the app so that YNAB can automatically transfer money into a separate account each day or each month via direct debit. Users can then set budgets for daily and monthly spending on automating savings.

5. Snap Scan

Snap Scan is a free app that allows users to scan items as they shop to create a receipt and save the item to the app. Once saved, you can then check that receipt on your phone or computer, which will allow you to buy the item with cash and save 10 percent to 25 percent on it.

6. Myfinance

MyFinance is an Android and iOS app that allows users to create budgets, track their spending, and keep track of the assets in their accounts. Users can view reports that break down their spending by category. The app also has features that allow users to see how much money they’ve saved and review transactions for the previous month or year.